A Power of Attorney (POA) in Dubai is not just a formality or a signature exercise. It is a legally binding authority that allows one person to act on behalf of another — often in matters involving property, business, banking, family affairs, or court proceedings. When drafted or used incorrectly, a POA can expose individuals and companies to serious legal, financial, and litigation risks.

As UAE-licensed advocates with over 25 years of legal practice, we routinely see POAs rejected by banks, challenged in court, or misused due to vague drafting or reliance on generic templates. This guide explains — in UAE-specific legal terms — what a Power of Attorney is, how it works in Dubai, and how to ensure it is valid, enforceable, and safe.

What Is a Power of Attorney (POA) in Dubai?

A Power of Attorney (POA) in Dubai is a formal legal instrument regulated by the UAE Civil Transactions Law that allows one person (the principal) to appoint another (the agent) to act on their behalf in legal, financial, or property-related matters. For a POA to be legally effective and accepted by UAE authorities and banks, it must be notarised by a UAE Notary Public. It may be issued as a General POA, which grants wide authority across multiple affairs, or as a Special POA, which limits the agent’s powers to a defined transaction such as a property sale or business representation.

POAs are widely used for banking, real estate dealings, and situations where the principal is travelling or unable to act personally, and they are commonly valid for up to two years unless renewed. If executed outside the UAE, the POA must be legalised by the UAE Embassy or Consulate and attested by the Ministry of Foreign Affairs before it can be used in Dubai. A POA automatically becomes void upon the death of the principal, and the principal must be physically present when signing before a notary or consular officer.

POA Full Form and Legal Meaning

POA stands for Power of Attorney. Under UAE law, a Power of Attorney is a written legal instrument by which a principal authorises another person (the attorney or agent) to act on their behalf in specified matters.

In practical terms, a POA allows the attorney to:

- Sign documents

- Represent the principal before authorities

- Conduct transactions within the limits stated in the POA

Once properly notarised and registered, a POA is treated as binding legal authority by government departments, banks, and courts across the UAE.

How a Power of Attorney Works Under UAE Law?

A Power of Attorney (POA) in the UAE is a legal document, usually required in Arabic, that authorizes an agent (attorney-in-fact) to act on behalf of a principal for specific or general legal, financial, and administrative matters. It must be notarized by a UAE Notary Public or, if signed outside, attested by the Ministry of Foreign Affairs.

In the UAE, a Power of Attorney operates within a strict legal framework and must comply with formal and procedural requirements to be valid.

Key legal characteristics include:

- The POA must be clearly drafted, defining the scope of authority granted

- It must be notarised before a competent notary

- The POA must be in Arabic (or bilingual, with Arabic prevailing)

- Authorities and courts rely strictly on the written wording — not verbal explanations or side agreements

Acts carried out outside the authority granted may be challenged as unauthorised and, in some cases, rendered unenforceable.

Because of this, UAE courts and regulators do not interpret POAs broadly by default. Any ambiguity is usually interpreted against the person relying on the POA.

Which Authorities Recognise Power of Attorney in Dubai?

In Dubai, a Power of Attorney (POA) is legally recognised by official bodies once it has been properly notarised by the Dubai Courts Notary Public and, where applicable, attested by the relevant government authorities for specific transactions or cross-border use. The acceptance of a POA depends on both correct notarisation and strict compliance with procedural requirements.

Authorities That Recognise a Notarised POA in Dubai

A duly notarised POA is generally accepted by the following entities, provided the granted powers match the intended use:

- Dubai Courts: POAs are recognised for appointing legal representatives, filing cases, pursuing claims, and handling all court and judicial proceedings.

- Dubai Land Department (DLD): A Special Power of Attorney is mandatory for real estate matters such as buying, selling, leasing, or managing property. The POA must clearly identify the property and expressly state the powers granted to the agent.

- Banks and Financial Institutions: Banks accept notarised POAs to allow agents to operate bank accounts, manage funds, make deposits or withdrawals, and apply for loans, subject to internal compliance checks.

- Government Departments:

- Department of Economic Development (DED): For business licensing, company incorporation, and amendments to corporate structures.

- General Directorate of Residency and Foreigners Affairs (GDRFA): For visa and residency matters, including sponsorship of family members or employees.

- Roads and Transport Authority (RTA): For vehicle-related transactions such as buying, selling, transferring, or registering a car.

- Dubai Municipality: For certain property and real estate matters outside the DLD’s direct jurisdiction.

- Free Zone Authorities: Free zones such as DIFC and DMCC recognise POAs that meet their internal requirements and procedural standards.

Attestation and Formal Requirements for POA Recognition

For a POA to be accepted by these authorities, it must satisfy specific legal and procedural conditions:

- Notarisation: The POA must be signed before a Dubai Notary Public, either in person or through the official e-notary system. This is the primary requirement for legal validity.

- Arabic Translation: If the POA is drafted in English or any other language, a certified Arabic translation prepared by a Ministry of Justice-accredited translator is required for acceptance by most government bodies and courts.

- Foreign-Issued POAs: A POA executed outside the UAE must go through a formal attestation process before it can be used in Dubai. This typically includes:

- Notarisation in the country of origin.

- Attestation by the Ministry of Foreign Affairs (or equivalent authority) in that country.

- Legalisation by the UAE Embassy or Consulate in the country of origin.

- Final attestation by the UAE Ministry of Foreign Affairs and International Cooperation (MOFAIC) upon arrival in the UAE.

- Ministry of Justice Certification: After MOFAIC attestation, the Arabic translation of a foreign POA must also be certified by the UAE Ministry of Justice before it is accepted by courts and government departments.

This structured approach ensures that a Power of Attorney is legally valid, enforceable, and recognised across all relevant authorities in Dubai and the wider UAE.

Why the Type of Power of Attorney Matters?

Not all POAs are the same. One of the most common mistakes in Dubai is using a general POA where a special POA is legally required — particularly for real estate, litigation, or corporate matters.

In the next section, we explain:

- The difference between General Power of Attorney and Special Power of Attorney

- When each is legally acceptable

- Why banks and courts often refuse broad or poorly drafted POAs

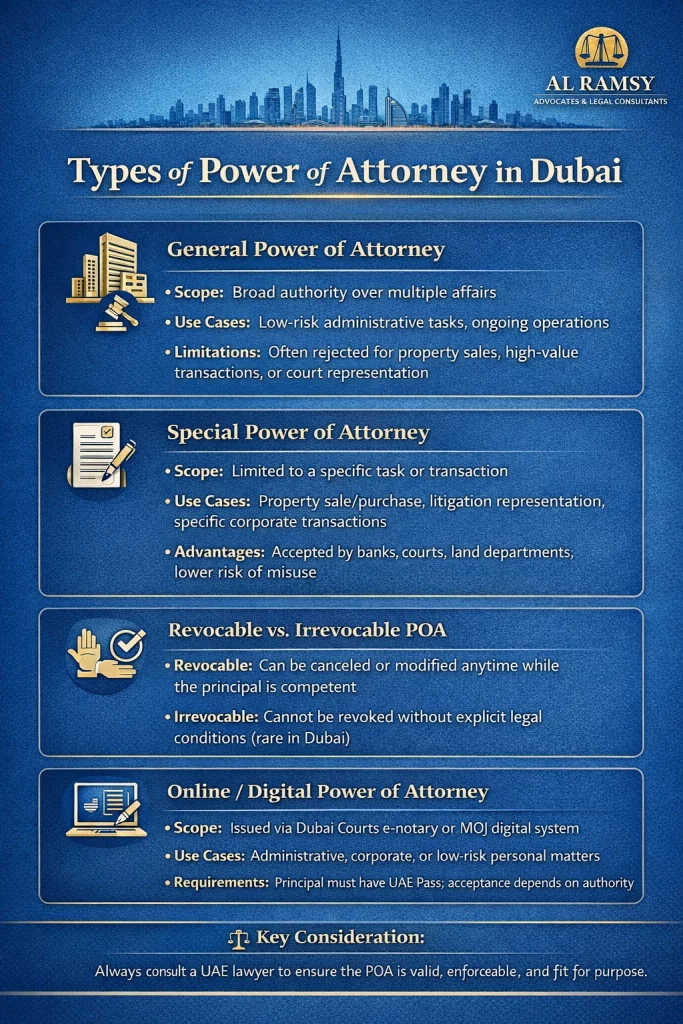

Types of Power of Attorney in Dubai

Choosing the correct type of Power of Attorney is critical under UAE law. Authorities, courts, and banks do not treat all POAs the same, and using the wrong type is one of the most common reasons POAs are rejected or later challenged.

Broadly, POAs in Dubai fall into two main categories: General Power of Attorney and Special Power of Attorney.

General Power of Attorney in Dubai

A General Power of Attorney grants wide authority to the attorney to manage the principal’s affairs.

It may include powers to:

- Manage bank accounts

- Operate businesses

- Sign contracts

- Represent the principal before authorities

- Handle general administrative matters

Legal Reality in Dubai

While general POAs sound convenient, UAE authorities increasingly limit their use, especially in high-risk or high-value transactions.

Important legal limitations:

- General POAs are often not accepted for property sales

- Banks may restrict reliance on broad POAs

- Courts scrutinise general POAs more closely in disputes

- Any ambiguity may invalidate the action taken

A general POA is usually suitable only for low-risk, ongoing administrative matters where authority does not involve disposal of assets or litigation rights.

Special Power of Attorney in Dubai

A Special Power of Attorney grants specific, clearly defined powers for a particular purpose or transaction.

Common examples include authority to:

- Sell or purchase a specific property

- Represent a party in court or arbitration

- Sign a defined commercial contract

- Act in a specific corporate transaction

- Complete a one-time government procedure

Why Special POAs Are Preferred

Under UAE legal practice:

- Courts prefer transaction-specific authority

- Land departments typically require special POAs

- Banks rely on clearly limited mandates

- The risk of abuse or overreach is significantly reduced

If a matter involves real estate, litigation, or corporate control, a special POA is almost always required

General vs Special Power of Attorney – Key Differences

| Aspect | General POA | Special POA |

|---|---|---|

| Scope of authority | Broad | Limited & specific |

| Risk level | High | Controlled |

| Acceptance by courts | Limited | High |

| Acceptance by banks | Restricted | Preferred |

| Property transactions | Usually rejected | Required |

| Litigation authority | Often insufficient | Mandatory |

Enduring or Limited Power of Attorney (UAE Context)

Unlike some jurisdictions, the UAE does not formally recognise “enduring POA” concepts that continue automatically after incapacity in the same way as common law systems.

Any POA in the UAE:

- Operates strictly within its written terms

- May become ineffective if legal capacity is questioned

- Should be reviewed carefully in family and succession planning

For sensitive family, health, or succession matters, POAs should be combined with wills and estate planning tools, often handled alongside will-writing services.

Lawyer’s Practical Insight

Many disputes arise because a client used a general POA thinking it “covers everything,” only to discover later that banks, courts, or land authorities refuse to recognise it. In Dubai, specific authority is safer authority.

When Do You Need a Power of Attorney in Dubai and the UAE?

A Power of Attorney (POA) is commonly used in Dubai when a person or company cannot be physically present or prefers to delegate authority for a legally significant act. However, UAE authorities are strict about when a POA is acceptable and what it must contain.

Below are the most common scenarios where a POA is legally required or practically essential.

Power of Attorney for Real Estate Transactions

Real estate is one of the most regulated areas for POAs in Dubai.

A POA is commonly used to:

- Sell or purchase property

- Sign Sale & Purchase Agreements (SPA)

- Appear before the land department

- Handover property or collect title deeds

Legal Requirements

- A Special Power of Attorney is mandatory

- The property must be clearly identified (plot number, unit number, location)

- The authority to sell, buy, mortgage, or transfer must be expressly stated

- The POA must be notarised and registered

General POAs are routinely rejected for property disposals.

If the transaction is disputed, courts will examine whether the POA granted explicit authority for that specific transaction.

Power of Attorney for Business and Corporate Matters

In commercial practice, POAs are frequently used to:

- Represent shareholders or directors

- Sign contracts and commercial agreements

- Attend meetings or complete regulatory filings

- Act on behalf of companies before authorities

However, corporate POAs must align with:

- The company’s Memorandum of Association

- Board or shareholder resolutions

- The scope of authority granted internally

Improper corporate POAs often result in:

- Rejected filings

- Invalid contracts

- Shareholder disputes

For complex matters, POAs are usually prepared alongside corporate and business law documentation to ensure consistency and enforceability.

Power of Attorney for Court Representation and Litigation

Court representation in the UAE requires strict compliance.

A POA is required when:

- Appointing a lawyer to represent you

- Filing or defending a case

- Attending hearings on behalf of a party

Key legal points:

- The POA must expressly authorise litigation and representation

- General wording is insufficient

- Courts reject POAs that do not clearly state litigation powers

This is particularly critical in commercial disputes, arbitration, and enforcement proceedings.

Power of Attorney for Family, Divorce, and Personal Matters

POAs are commonly used in:

- Divorce proceedings

- Family disputes

- Collection of documents

- Representation before personal status courts

However, family-related POAs require careful drafting:

- Authority must be clearly limited

- Sensitive rights cannot be implied

- Courts scrutinise consent and capacity closely

For family and personal matters, POAs are often combined with family law and estate planning services to avoid misuse or misunderstanding.

Power of Attorney for Overseas or Absent Principals

Many POAs in Dubai are issued because:

- The principal resides outside the UAE

- The principal cannot attend in person

- The transaction is time-sensitive

In such cases:

- Foreign-issued POAs require attestation

- Local notarisation rules still apply

- UAE authorities will not rely on unsigned or unverified documents

This is particularly common with Indian, UK, US, and other foreign nationals dealing with UAE assets or legal matters.

Practical Legal Warning

A POA is not a “shortcut.” In Dubai, it is a controlled delegation of authority. If the wording is too broad, too vague, or inconsistent with the intended act, authorities will simply refuse to act on it.

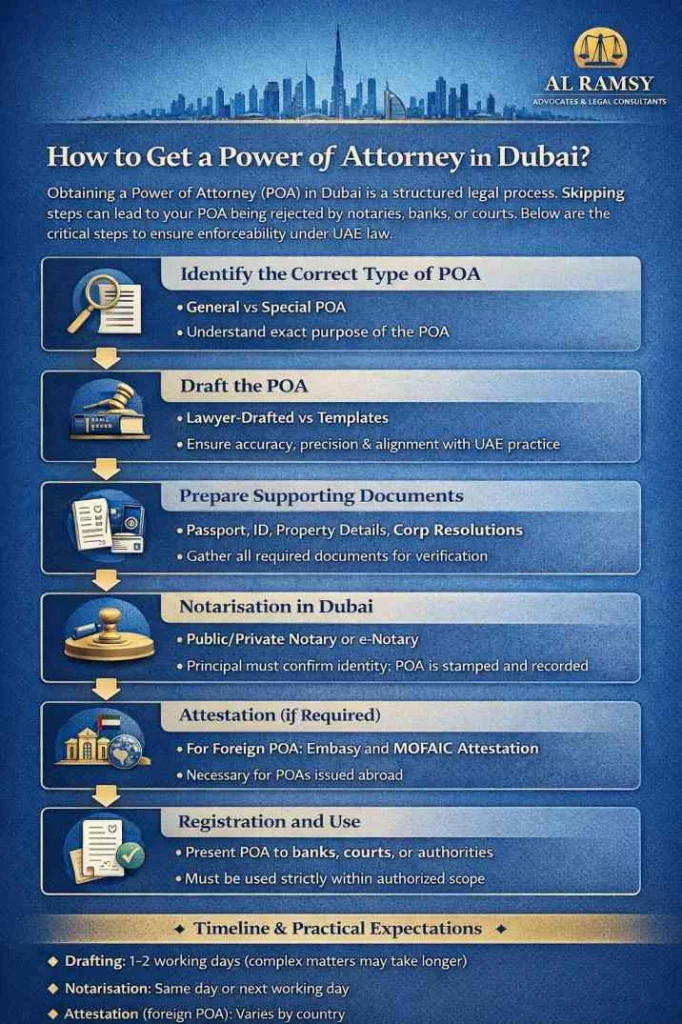

How to Get a Power of Attorney in Dubai? (Step-by-Step Legal Process)

Obtaining a legally valid Power of Attorney (POA) in Dubai is a structured legal process. Skipping steps or relying on informal drafting is the fastest way to have your POA rejected by notaries, banks, or courts.

Below is the practitioner-led process we follow to ensure enforceability under UAE law.

Step 1: Identify the Correct Type of POA

Before drafting anything, you must determine:

- General vs Special POA (most transactions require special)

- Exact purpose (property sale, court case, bank dealings, company matters)

- Who the attorney will be (individual, lawyer, company representative)

Legal risk note: Choosing the wrong POA type cannot be “fixed” later without re-notarisation.

Step 2: Draft the POA (Template vs Lawyer-Drafted)

A POA must be:

- Clear, precise, and limited

- Aligned with UAE legal practice

- Suitable for the specific authority that will rely on it (court, bank, land department)

Why lawyer drafting matters

Generic templates often:

- Use non-UAE legal concepts

- Grant authority that is too broad or legally defective

- Omit mandatory wording required by notaries or courts

For real estate, litigation, corporate, or high-value matters, POAs should always be drafted or reviewed by UAE-qualified lawyers.

Step 3: Prepare Supporting Documents

Typically required:

- Passport and Emirates ID (if resident)

- Attorney’s identification

- Property or transaction details (if applicable)

- Corporate resolutions (for company POAs)

- Proof of relationship or authority where relevant

Any discrepancy between documents and the POA wording can delay or invalidate notarisation.

Step 4: Notarisation in Dubai (In-Person or Online)

A POA becomes legally effective only after notarisation.

Options include:

- Public notary (Dubai Courts)

- Private notary (authorised offices)

- Digital / e-notary services (where eligible)

Key points:

- The principal must confirm identity and consent

- The notary verifies capacity and clarity of authority

- The POA is registered and stamped

Important: Notarisation is not a rubber stamp. Notaries routinely reject vague or defective POAs.

Step 5: Attestation (If Required)

Attestation is required when:

- The POA is issued outside the UAE

- The POA will be used across borders

- A foreign authority issued the document

This may involve:

- Embassy or consular legalisation

- Ministry-level attestation inside the UAE

Without proper attestation, foreign POAs are routinely refused.

Step 6: Registration and Use

Once notarised:

- The POA can be presented to banks, courts, or authorities

- Some institutions require internal registration or verification

- The POA must be used strictly within its stated scope

Any act beyond the written authority may be legally challenged.

Timeline & Practical Expectations

- Drafting: 1–2 working days (complex matters may take longer)

- Notarisation: Same day or next working day

- Attestation (foreign POA): Varies by country

Delays usually occur due to poor drafting, not bureaucracy.

Online & Digital Power of Attorney in Dubai

Dubai has significantly modernised notarial services, and online / digital Power of Attorney (POA) issuance is now possible in many situations. However, not every POA can be issued or relied upon digitally, and misunderstanding this is a common cause of rejection.

Dubai Courts & MOJ Digital POA Systems

In Dubai and across the UAE, digital POAs may be issued through:

- Dubai Courts (e-Notary services)

- Ministry of Justice UAE (federal digital POA platform)

These systems allow eligible principals to:

- Appear before a notary remotely

- Verify identity via UAE Pass

- Sign and notarise POAs through secure video authentication

The digitally notarised POA carries the same legal weight as a physically notarised document — provided it meets legal requirements.

When Online POA Is Accepted

Digital POAs are commonly accepted for:

- Administrative and personal matters

- Limited business authorisations

- Certain banking and corporate representations

- Appointment of lawyers (subject to court acceptance)

The key requirement is that:

- The principal has UAE Pass

- The authority granted is clear and specific

- The receiving authority confirms acceptance of digital format

When Online POA Is Not Accepted

Despite the convenience, online POAs are often rejected for:

- Property sales or transfers requiring land department appearance

- Complex corporate restructurings

- High-value asset disposals

- Cross-border use without attestation

Some authorities still require:

- Physical notarisation

- Additional verification

- Separate internal approvals

Practical warning: Just because a POA can be issued online does not mean it will be accepted everywhere.

Online POA vs Lawyer-Managed POA

Many online services focus only on issuance, not enforceability.

Common risks include:

- Overly generic authority wording

- No alignment with bank or court requirements

- No legal advice on scope or revocation risks

For matters involving real estate, litigation, or business control, lawyer-managed drafting combined with digital notarisation is the safest approach.

Indian & Foreign Nationals Using Online POA

Foreign nationals residing in the UAE may use digital POA only if:

- They hold valid UAE residency

- UAE Pass is activated

- The receiving authority confirms acceptance

For principals outside the UAE, foreign-issued POAs must still be attested before use in Dubai.

Lawyer’s Insight

Digital POA is a tool — not a substitute for legal judgment. The strongest POAs in Dubai are those that combine correct legal drafting with proper notarisation, whether digital or physical.

Cost of Power of Attorney in Dubai

The cost of a Power of Attorney (POA) in Dubai depends on the type of POA, the notarisation method, and whether legal drafting or attestation is required. One of the most common misconceptions is assuming all POAs cost the same — they do not.

Typical POA Costs in Dubai

While fees may vary, the cost usually includes two components:

- Notary fees, and

- Legal drafting or review fees (where applicable).

Notary Public Fees

- Standard notarisation (Dubai Courts / Private Notary):

Usually ranges from AED 200 to AED 500, depending on the POA type and number of pages. - Digital / e-notary POA:

Similar range, subject to system eligibility and document complexity.

Legal Drafting & Review Fees

- Simple administrative POA: lower range

- Special POA (property, litigation, corporate): higher range due to precision drafting

- Foreign or bilingual POAs: additional review costs

Important: A cheaper POA that later gets rejected or challenged often becomes far more expensive than doing it correctly from the start.

What Increases the Cost?

- Multiple or complex powers

- Property descriptions or transaction-specific authority

- Corporate POAs requiring resolutions

- Foreign POA attestation

- Urgent or same-day processing

Foreign Power of Attorney & Attestation in Dubai

Many POAs used in Dubai are issued outside the UAE, especially by non-residents. These POAs are not valid by default and must go through a formal attestation process.

Indian Power of Attorney Attestation in Dubai

Indian nationals commonly issue POAs from India for use in the UAE. For such POAs to be accepted, they generally require:

- Notarisation in India

- Attestation by relevant Indian authorities

- UAE Embassy attestation in India

- MOFA attestation in the UAE

Without this chain, UAE authorities, banks, and courts will refuse the document outright.

UK, US, and Other Foreign POAs

The same principle applies to POAs issued in:

- The UK

- The US

- Europe

- Other jurisdictions

Each country has its own attestation sequence, but MOFA attestation in the UAE is mandatory before use.

Legal reality: A foreign POA that is not properly attested is treated as non-existent in UAE legal practice.

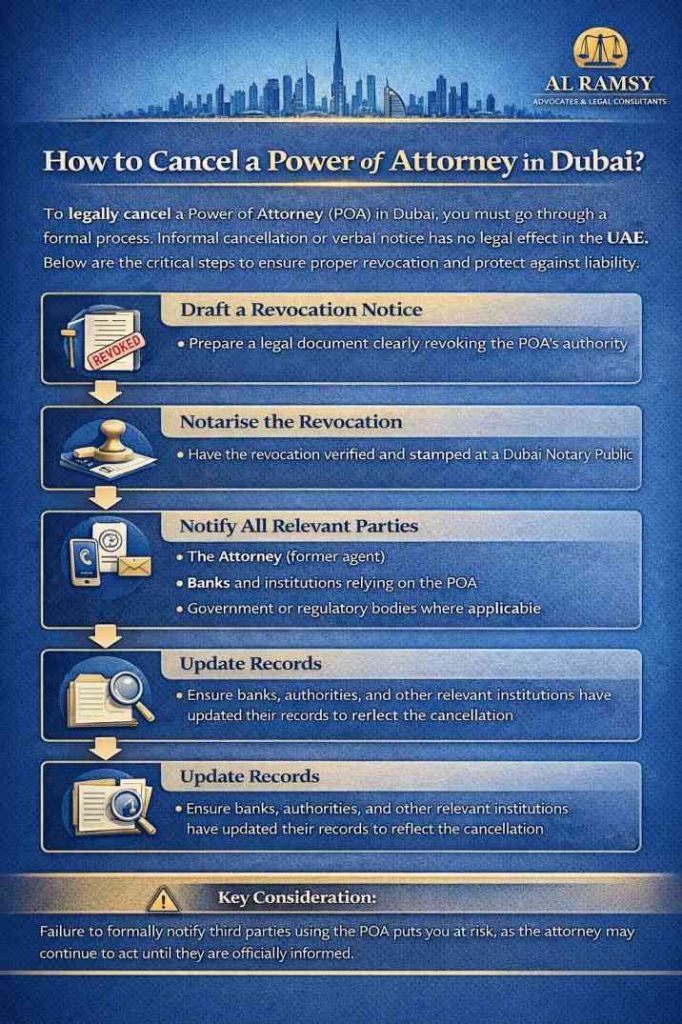

How to Cancel or Revoke a Power of Attorney in Dubai?

A Power of Attorney does not last forever and can generally be revoked — but only through the correct legal process.

When Should You Cancel a POA

- Relationship breakdown with the attorney

- Completion of the original purpose

- Risk of misuse or overreach

- Change in personal, business, or financial circumstances

Legal Process to Cancel a POA

- Draft a revocation notice

- Notarise the revocation

- Notify:

- The attorney

- Relevant authorities

- Banks or institutions relying on the POA

- Update records where required

Failure to notify third parties may leave the principal exposed to liability, even after revocation.

Court & Bank Reality

- Courts may still recognise actions taken before formal notice

- Banks often require direct notification

- Informal cancellations carry no legal weight

Common Mistakes With Power of Attorney in Dubai

1. Using Generic or Foreign Templates

These often:

- Refer to incorrect laws

- Grant invalid or excessive powers

- Are rejected by notaries or courts

2. Overly Broad Authority

“Do everything on my behalf” language is legally dangerous and frequently challenged.

3. No Revocation Strategy

Many principals forget to cancel POAs after use, creating long-term risk.

4. Misalignment With Actual Use

If the POA does not match how it is used, disputes and rejection are likely.

How Al Ramsy Advocates & Legal Consultants Can Help

At Al Ramsy Advocates & Legal Consultants, we assist clients with every aspect of Power of Attorney matters in Dubai and the UAE, including:

- Drafting and reviewing general and special POAs

- Handling notarisation and digital POA issuance

- Managing foreign POA attestation

- Advising on revocation and misuse prevention

- Representing clients in POA-related disputes and litigation

Our approach is lawyer-led, not administrative, ensuring your POA is enforceable, safe, and aligned with UAE legal practice.

If you are unsure whether your POA will be accepted or want to protect yourself from risk, speaking to a UAE lawyer early can prevent costly consequences.

Power of Attorney in Dubai – Frequently Asked Questions

What is a Power of Attorney in Dubai?

A Power of Attorney (POA) in Dubai is a notarised legal document authorising one person (the attorney) to act on behalf of another (the principal) for specific matters such as property, business, banking, or court representation. Under UAE law, a POA must be clearly drafted, notarised, and usually issued in Arabic to be legally valid.

What is the full form of POA?

POA stands for Power of Attorney. In UAE legal practice, it refers to a formal written authority that allows an appointed person to legally represent or act for another within the limits specified in the document.

Is a Power of Attorney legally valid in Dubai?

Yes. A Power of Attorney is legally valid in Dubai only if it is properly notarised by a recognised notary (Dubai Courts, authorised private notary, or MOJ digital system) and complies with UAE legal requirements. Unnotarised or improperly drafted POAs are not recognised by courts or authorities.

Can I make a Power of Attorney online in Dubai?

Yes, in certain cases. Dubai allows online or digital POA issuance through authorised e-notary platforms, provided the principal has UAE Pass and the receiving authority accepts digital POAs. However, some transactions — particularly real estate or high-value matters — may still require physical notarisation.

What is the difference between General and Special Power of Attorney in Dubai?

A General Power of Attorney grants broad authority for multiple matters, while a Special Power of Attorney grants authority for a specific task or transaction. In Dubai, courts and authorities usually require special POAs for property sales, litigation, and corporate transactions due to higher legal risk.

Which Power of Attorney is required for property transactions in Dubai?

A Special Power of Attorney is mandatory for property transactions in Dubai. The POA must clearly identify the property and expressly authorise the sale, purchase, transfer, or mortgage. General POAs are commonly rejected for real estate matters by land authorities.

How much does a Power of Attorney cost in Dubai?

The cost of a Power of Attorney in Dubai varies depending on the type and complexity. Notary fees typically range from AED 200 to AED 500, while legal drafting or review may involve additional costs, especially for special, corporate, or foreign-related POAs.

Can a Power of Attorney be cancelled in Dubai?

Yes. A Power of Attorney can be revoked in Dubai by executing a formal notarised revocation and notifying the attorney and relevant authorities. Informal cancellation or verbal notice has no legal effect under UAE law.

How long is a Power of Attorney valid in the UAE?

A Power of Attorney remains valid until revoked, expires by its own terms, or becomes legally ineffective due to incapacity or death of the principal. UAE law does not treat POAs as automatically “enduring” unless properly structured and legally supported.

Is a foreign Power of Attorney valid in Dubai?

A foreign Power of Attorney is not valid in Dubai unless fully attested. This usually includes notarisation in the home country, embassy or consular attestation, and MOFA attestation in the UAE. Without attestation, UAE authorities will reject the document.

How do I use an Indian Power of Attorney in Dubai?

An Indian Power of Attorney must be notarised in India, attested by relevant Indian authorities, legalised by the UAE Embassy in India, and finally attested by MOFA in the UAE. Only after this process will it be accepted in Dubai.

Can a lawyer represent me in Dubai courts using a POA?

Yes, but only if the Power of Attorney expressly authorises litigation and court representation. UAE courts reject POAs with general wording that does not specifically grant the right to file cases, attend hearings, or appoint legal counsel.

Do banks accept Power of Attorney in Dubai?

Banks in Dubai accept POAs only after internal verification and usually prefer special, transaction-specific POAs. Broad or outdated POAs are frequently rejected, particularly for account access or financial transactions.

Is Arabic mandatory for a Power of Attorney in Dubai?

Yes. Under UAE legal practice, the Arabic version is mandatory and legally binding. English versions may be used for reference, but in case of conflict, the Arabic text prevails.

What happens if a Power of Attorney is misused?

If a Power of Attorney is misused or exceeds its authority, the affected party may:

- Challenge the actions before UAE courts

- Seek civil liability against the attorney

- Face disputes with banks or authorities

This is why POAs must be narrowly drafted and carefully monitored.

Do I need a lawyer to prepare a Power of Attorney in Dubai?

While not legally mandatory, involving a UAE lawyer is strongly recommended for real estate, litigation, corporate, or high-value matters. Lawyer-drafted POAs reduce rejection risk and protect against misuse or legal disputes.